Table of Content

- First Time Homebuyer WorkshopFirst Time Homebuyer Workshop

- First Time Home-Buyer Workshop - JanuaryFirst Time Home-Buyer Workshop - January

- In the last decade, first-time homebuyers represented at least 40% of the home-buying population

- Our Free Maryland home buyer seminars are held at the following locations

- Home Loan & Incentives WorkshopHome Loan & Incentives Workshop

- Get to know NHS of Baltimore

- Watch ABC News Live

This should consist of a HUD approved first time homebuyers workshop, coupled with an individual session with a housing counselor. The workshop will give you a solid foundation for the entire process; starting with financing, home selection, negotiation, closing and finally keeping your new home. There is a wealth of information to be gained from the industry professionals that speak at each session. The individual sessions with counselors will be specific to your individual situation. The discussion will center around credit, employment, budget and savings.

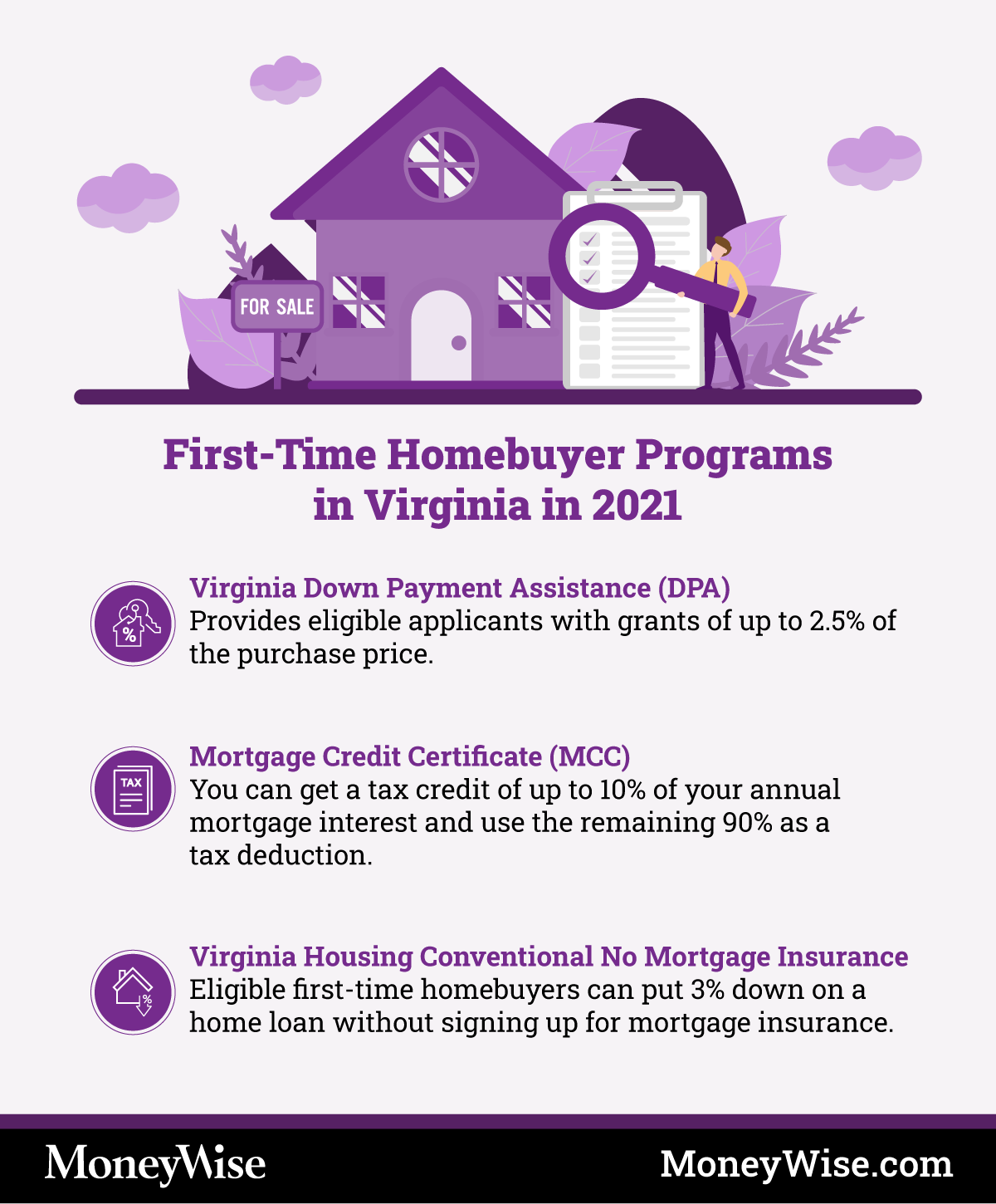

Most credit issues can be handled on your own, free of charge. Most agencies ask that you pre-register for group classes. Baltimore City and all Maryland Counties home buyer incentives and down payment assistance funds are available. Counselors from Belair-Edison Neighborhoods, Inc., work closely with the homebuyer through every step in an effort to simplify and reduce the stress of the process. The chart below shows incentives that are currently available for each program.

First Time Homebuyer WorkshopFirst Time Homebuyer Workshop

While the pandemic did push up prices, new homebuyers jumped into the market at increasing rates. Chart showing first-time homebuyers as a share of total home purchases. Can afford at least a 3% downpayment and related closing costs.

Please note that homeownership incentive checks are generally issued business days after applications are approved. Unexpected delays related to the COVID-19 pandemic may also occur. Please plan accordingly and submit your application as early as possible, but no later than thirty days before settlement. This course allows you to attend at any time you choose and move at your own pace.

First Time Home-Buyer Workshop - JanuaryFirst Time Home-Buyer Workshop - January

The first time home buyer seminar will cover all of the basics of buying a new home in Maryland. The home buyer seminar will cover Maryland FHA loans, Maryland VA loans, Maryland USDA Rural Housing Loans, First Time Home Buyer Loan Programs and the Maryland FHA 203k Rehab loans. This is the most recommended First Time Home Buyer Seminar in Maryland.

Please note that your housing counseling agency and lender must complete the online application if you are applying for the First-Time Homebuyers Incentive Program. The Office of Homeownership offers a variety of incentive programs to homebuyers purchasing in Baltimore City. Texas Real Estate Source examined historical data from the Census Bureau’sAmerican Housing Survey to see how the share of first-time home buyers has changed in the last 10 years time. A sale is considered a first-time home purchase if neither the primary buyer nor any co-buyer has ever owned another home as a primary residence. In addition to exploring how the rate of first-time home buyers has evolved, the 25 cities with the highest share of first-time homebuyers have been listed .

In the last decade, first-time homebuyers represented at least 40% of the home-buying population

First time homebuyers are mandated to attend a first time buyer workshop, in order to receive federal, state and/or Baltimore County funds. A homebuyer must also have a one-on-one counseling session, to receive a certificate. Both the workshop and one on one are required for any designated funding for first time homebuyers. In our first time homebuyers (pre-purchase) workshops, a potential homebuyer will learn about the down payment and closing cost assistance programs. The homebuyer will also learn the process of purchasing a home, as well as budgeting, savings and credit. Typically, our homebuyers’ workshops are held at the local libraries in the NW area of Baltimore County.

The Packers needed Taylor as a third running back behind Aaron Jones and A.J. Because the Packers didn’t have a gameday elevation to use, they had to open up a roster spot, and Watkins ended up being cut with the team getting healthier at the receiver position. Keep reading to see how the rate of first-time home buying has changed over time and which metros have the highest rate of these buyers. The mission of Diversified Housing Development, Inc. is to promote affordable housing options for low and moderate-income families resulting in economic empowerment and strengthened communities. Opinions expressed on this website and in seminars and discussions belong to the individual and do not reflect the views held by Primary Residential Mortgage, Inc. Have reliable income, good credit, and documentation to verify your savings.

Our Free Maryland home buyer seminars are held at the following locations

Acquiring a Homeownership Counseling Certificate usually involves attending one group class and one individual appointment. Contact each agency for its specific offerings, program requirements, and fees. Your Presenter for the Maryland Home Buyer Seminar is the author of the new book, Your Guide to Buying Your First Home in Maryland. The information presented in the home buying seminar is based on the book and will walk each prospective buyer through the whole home buying process for purchasing a home in Maryland. If you are looking to learn from the expert on home buying in Maryland then this is a must attend event.

The course also offers quizzes to ensure that you thoroughly understand the information that is presented. Others ask for a small administrative fee or charge for pulling your credit report ($15 to $20). Ask about fees before registering for your group class.

This workshop is open to any first time home buyers who are planning topurchase a home in Baltimore County. First-Time Homebuyers Incentive Program - Formerly known as the CDBG Homeownership Assistance Program, this program has been rebranded and revamped! For applications submitted on or after May 1, 2022, the base incentive amount is $10,000 for first-time homebuyers with a household income at or below 80% of the area median income.

Without this information, your case WILL NOT BE PROCESSED. Thank You. Purchase rates of first homes have remained fairly steady since 2021. First-time homebuyers have made up a sizable proportion of the overall home-buying population for the last 10 years, hovering just over 40%, according to the Census Bureau’s American Housing Survey. That percentage jumped slightly between 2019 and 2021 to a 10-year high.

Our one-on-one counseling sessions are during the day, at our office. Some agencies offer additional services, such as post-purchase education, default and delinquency counseling, community outreach, and credit and budgeting classes. Nearly all homebuying incentive programs require that you earn a Homeownership Counseling Certificate from a City-approved counseling agency BEFORE making an offer on a home. All incentives are provided as five-year forgivable loans except for Live Near Your Work, which is offered as a grant. When using Baltimore City homebuying incentive programs, you must obtain your Homeownership Counseling Certificate from a City-approved counseling agency.